第六章 完全競爭與獨佔

- 完全競爭的特性

- 完全競爭的四個特性:

- 廠商為價格的接受者,無法影響價格

- 生產同質性產品,所以不必從事非價格的競爭

- 買賣雙方都具有充分資訊

- 生產者可以自由的加入或退出

- 市場結構:對市場內買方與賣方行為的一種描述

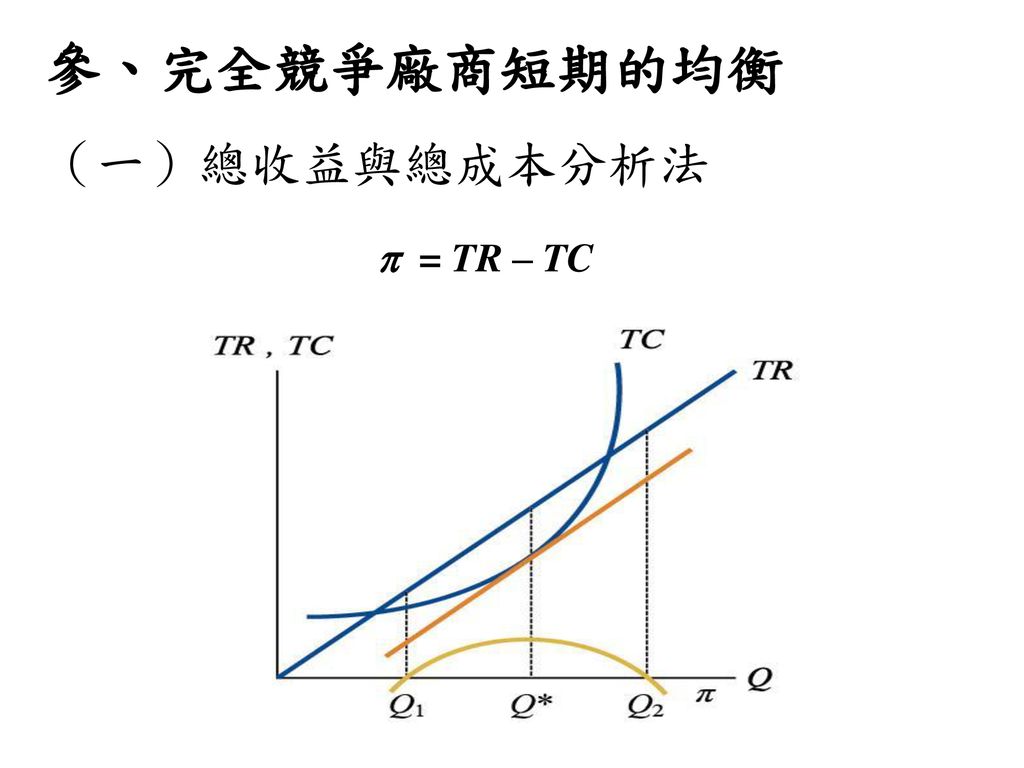

- 總收益與總成本分析法

將項目的收益收入與成本(費用)進行對比,用凈收入和收入成本比率來評價項目經濟效益的一種方法。 - 最適產量:最大利潤或最小虧損時的產量

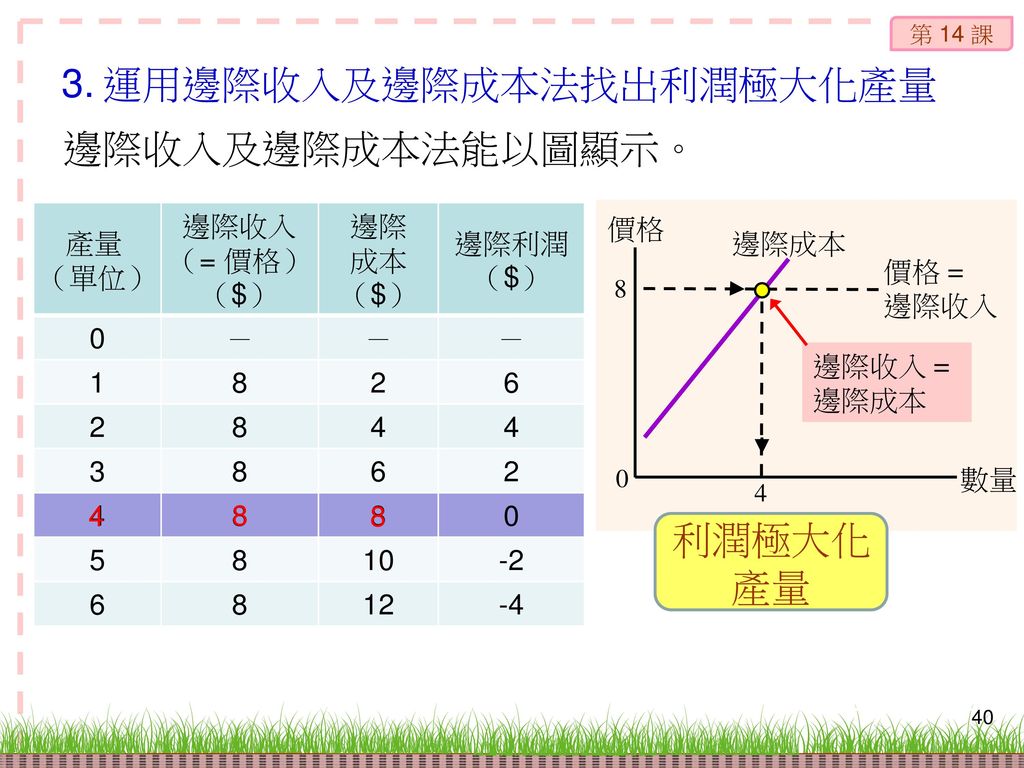

- 邊際收益與邊際成本分析法

- 完全競爭短期的供給曲線

- P1時,平均收益大於平均成本

- P2時,廠商處於SAC的最低點,因為平均收益等於平均成本,所以利潤為0

此點稱為損益兩平點 - P3時,平均收益低於平均成本,處於虧損狀態

然價格仍高於AVC(平均變動成本),因此持續經營能收回全部的變動成本與部分的固定成本,因此繼續生產。 - P4時,處於AVC的最低點,平均收益等於平均變動成本,固定成本完全無法收回

依據產業未來前景,決定是否停工 - P5時,平均收益低於平均變動成本,連變動成本都無法收回,只能停工了

- 整理:

- P>AC,有利潤存在,繼續生產

- AVC<P<AC,虧損,但繼續生產

- AVC=P,虧損,生產與否取決於廠商對市場前景的看法

- P<AVC,虧損,關廠

- 完全競爭廠商的短期供給曲線,是在邊際成本曲線上平均變動成本最低點以上的部分

(也就是上圖,SMC線E4點以上的部分) - 完全經爭的長期分析

長期分析的話,要同時考慮個別廠商生產規模的改變與廠商總數的變化 - 生產者的長期均衡會是平均收益曲線與長期平均成本曲線相切於最低點,同時也是長期邊際成本等於短期邊際成本等於長期平均成本的一點

P=AR=MR=SRMC=LRMC=SRAC=LRAC

此時,完全競爭廠商是以最有效率的產能從事生產 - 獨佔的市場結構

獨佔只有一家廠商,所以該一廠商就形成一個產業

與完全競爭最大差別在於對市場價格的影響,獨佔具有市場力量,也就是價格的設定者。

市場立場就是有設定價格的能力,而又不會失去整個市場佔有率 - 唯一的生產者

因為是唯一的產商,所以成為價格的設定者 - 單一產品

單一產品意指沒有近似的替代品 - 其他廠商不容易進入

意指廠商掌握重要的生產要素,法律的障礙與規模經濟 - 重要的生產要素

掌握生產該產品最主要的生產要素,例如原料 - 法律的障礙

如政府核發的執照、專利權與著作權都是 - 規模經濟

某些行業因為需要投入大量的固定成本,如果同時存在許多廠商,每家廠商所分得的銷售量相對減少,使得單位生產成本過高,反而對廠商不利,此種行業容易形成獨佔。

因規模經濟而形成獨佔,稱為自然獨占

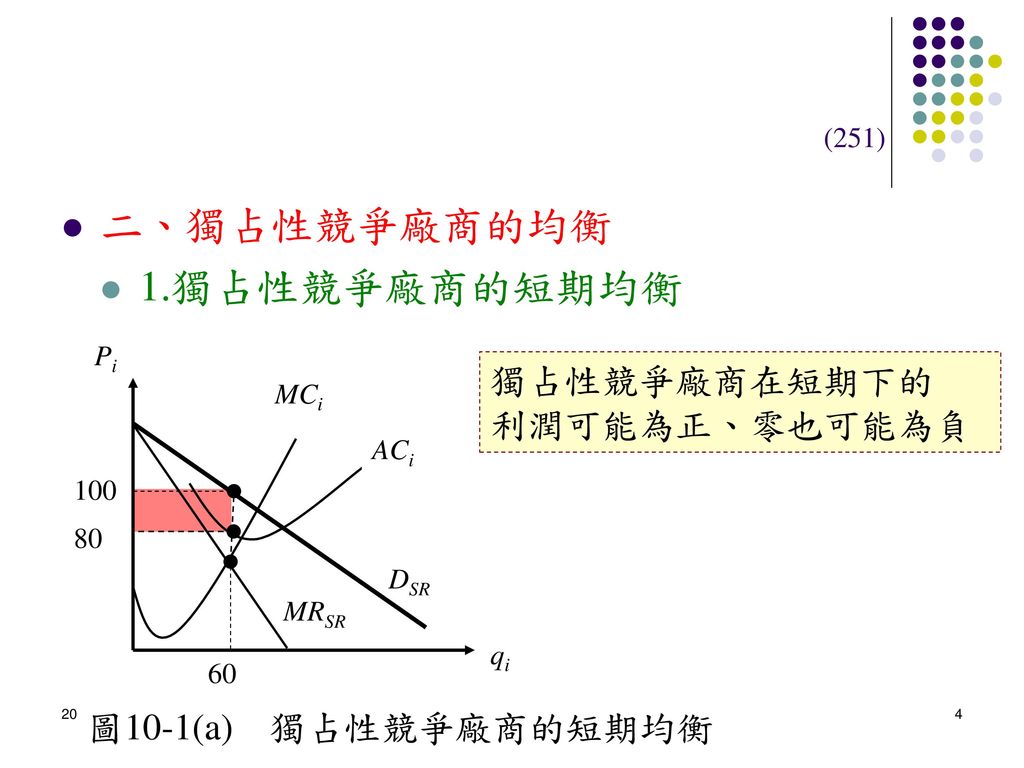

例如自來水公司 - 獨佔的市場分析

獨佔者的獲利與否,取決於成本結構與消費者的需求曲線

(圖中以MR=MC 來決定產量60,對應到的D線(100)高於AC線(80),因此有利潤) - 獨佔的長期分析

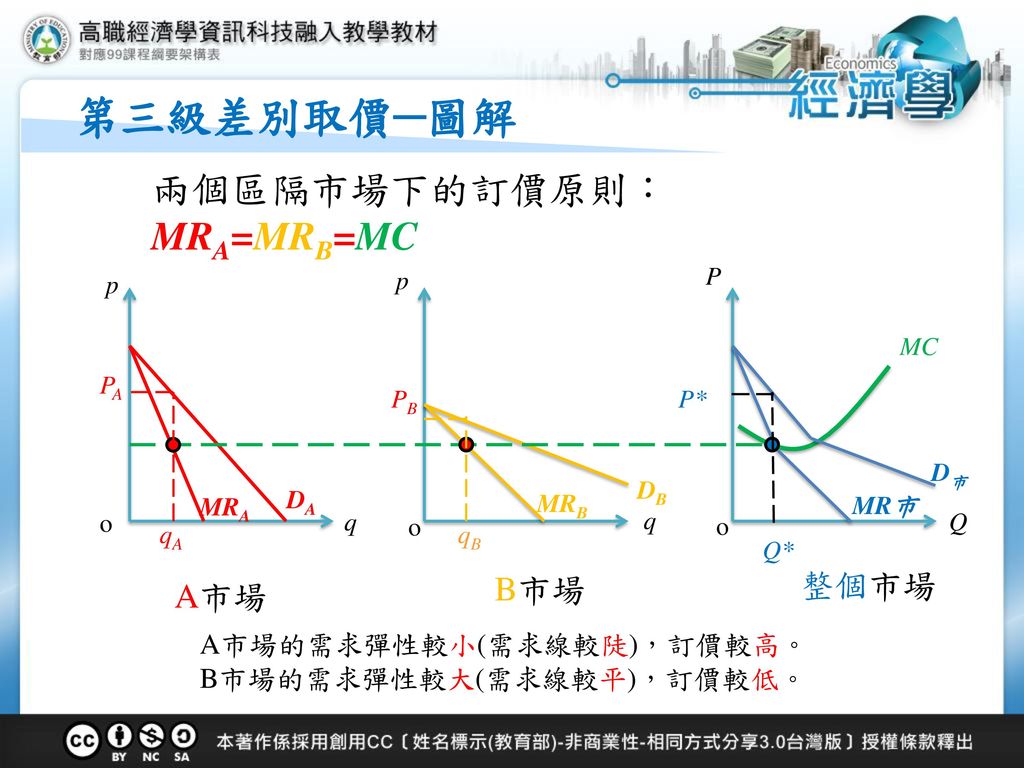

獨佔者雖然為市場中某一產品的唯一生產者,但是因為面對間接的競爭者與潛在的競爭者,所以不可能將價格隨意的調高。 - 差別定價

在相同的成本之下,對不同消費者收取不同的價格以獲取最大利潤

- 差別定價的作法

對於需求彈性小的市場收取較高的價格,對於需求彈性大的市場收取較低的價格,如此才可以使得廠商收益最大 - 差別定價的條件

- 廠商是價格的設定者,面對負斜率的需求線

- 廠商要能區隔兩個市場,亦即兩個市場對其產品的需求彈性不同

- 消費者無法對所購進產品進行套利的行為,也就是無法低價買進高價賣出

- 差別定價的例子

- 電影院的成人票與學生票

- 電價分工業用電與家庭用電

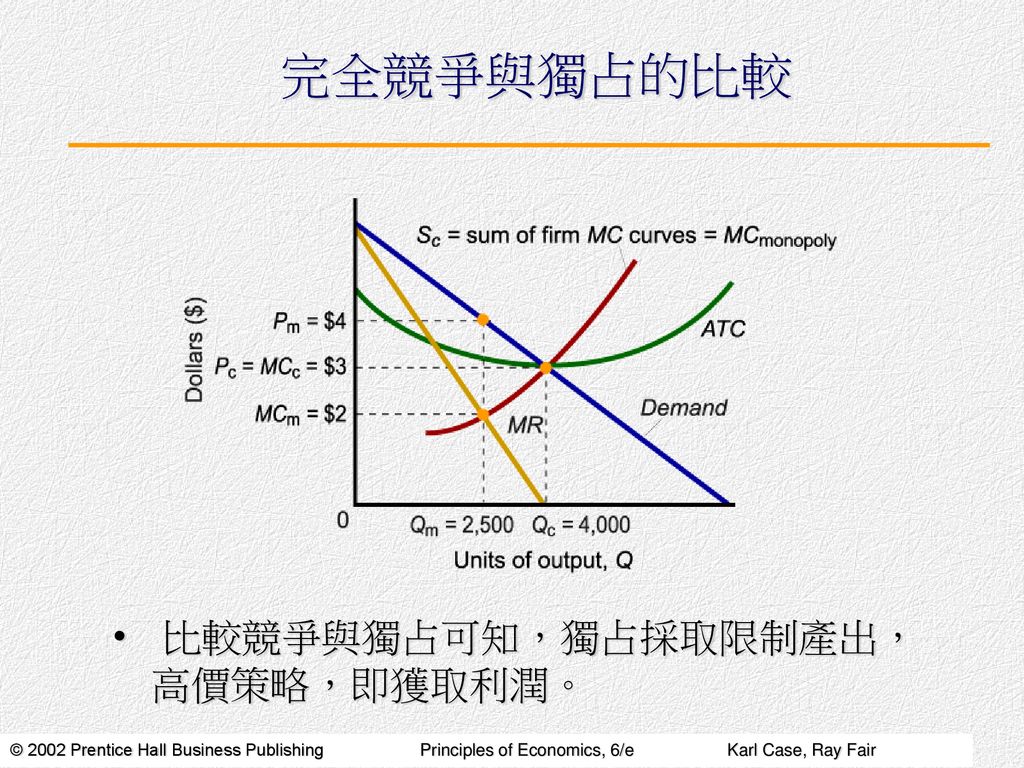

- 完全競爭與獨占的比較

- 對獨佔的批評

- 獨佔的價格較高、產量較低

- 獨佔

根据MR=MC,決定產能2500與價格$4(對照需求曲線) - 完全競爭

供給曲線:MC在AVC最低點以上的部分

(將個別廠商的供給曲線水平相加,就成為一產業的供給曲線)

需求曲線:AR(平均收益曲線)

由供給與需求相交的點,決定產能4000,價格$3 - 獨佔能運用市場力量,以降低產量的方式達到抬高售價的目的

當價格相當高時,會使得MR大於MC,違反利潤最大的原則

(當利潤最大時,MR=MC) - 獨佔造成無謂的損失

無謂的損失意指因無效率的生產,導致生產者剩餘與消費者剩餘減少,亦是經濟福利的下降 - 獨佔不符合資源配置的效率

獨佔時價格高於MC,不符合邊際成本的效率

以及,對應到的平均成本高於完全競爭時的平均成本 - 贊成獨佔者的看法

熊彼德認為不完全競爭市場之下,技術進步的可能性較完全競爭為高,技術進步有助於生產力的提升與物質生活的改進 - 獨占與價格管制

- 平均成本定價法

政府管制的價格定在平均成本(包括合理的投資報酬率)與平均收益(需求曲線)相等的地方 - 邊際成本定價法

政府管制的價格訂在邊際成本與平均收益相等的地方

因為平均收益小於平均成本,廠商會發生虧損,政府會予以補貼

常用於公營事業 - 以增稅補貼的兩個影響

- 資源配置的不當

- 所得重分配的效果,有利於公營事業的使用者,不利於公營事業的非使用者

- 自然獨占事業

自然獨佔的形成是因為規模經濟的關係。

在規模經濟之下,長期平均成本隨著產量的增加而遞減。

若要達成資源配置的效率,必然虧損

若要追求獲利,生產必然不具資源配置的效率

-------------------------------------------------------------------------------------

- A perfectly competitive firm is observed to make zero economic profit.

This implies that its:

A:

A firm’s economic profit is the difference between its total revenue and the sum of its explicit and implicit costs. So, its economic profit is zero when its total revenue is equal to the sum of its explicit and implicit costs. - True or false: Explain why the following statements are true or false:

- The econmic maxim "There's no cash on the table"means that there are never any unexploited economic opportunities

A:

False. The maxim tells us that there are no unexploited economic opportunities when the market is in long-run equilibrium. In fact, there often are unexploited economic opportunities in the short run when markets are not in equilibrium. - Firms in competitive environments make no accounting profit when the market is in long-run equilibrium.

A:

False. Firms in long-run equilibrium make zero economic profits. They make a positive accounting profit since, in order to stay in business, the firm must earn enough revenue to cover both explicit costs and implicit costs. Thus, accounting profit, which is equal to total revenue minus explicit costs, must equal the opportunity cost of the owner’s resources that have been invested in the firm - Firms that can introduce cost-saving innovations can make an economic profit in the short run.

A:

True. Firms that introduce cost-saving innovations can earn economic profits until other firms adopt their innovations. As the innovations spread, the industry curve will shift right, causing the market price of the good to fall and short-term economic profits to fall - John Jones owns and manages a cafe in Collegetown whose annual revenue is $5000.

Annual expenses are as follows

- Calculate John's annual accounting profit

A:

John’s accounting profit is his revenue minus his explicit costs: $5,000 - $4,250 = $750 - John could earn $1000 per day year as a recycler of aluminum cans. However, he prefers to run the cafe. In fact, he would be willing to pay up to $275 per year to run the cafe rather than to recycle. Is the cafe making an economic profit?

Should John stay in the cafe business? Explain

A:

In this case, John’s opportunity cost to run the café is $725 per year ($1,000 - $275 = $725). Thus, the café is making an economic profit of $25 per year ($5,000 - $4,250 - $725 = $25). Since the café is earning an economic profit, John should stay in the café business. - Refer to Problem 3.

- Suppose the cafe's revenues and expense remain the same, but recyclers' earnings rise to $1100 per year. Is the cafe still making an economic profit? Explain.

A:

In this case, John's opportunity cost of running the café is $825 per year ($1,100 –

$275 = $825). Thus, the café is earning an economic loss of $75 per year ($5,000 - $4,250 - $825 = -$75). Since the café is earning an economic loss, John should not stay in the café business. - Suppose John had not had to get a $10000 loan at an annual interest rate of 10 percent to buy equipment, but instead had invested $10000 of his own money in equipment. How would your answers to 3a and 3b change?

A:

John’s accounting profit equals his revenue minus his explicit costs. The answer

to part a changes: If he doesn’t need a loan, then his explicit costs equal $3,250. So, his accounting profit equals $1,750 ($5,000- $3,250 = $1,750).

The answer to part b does not change. If John invested $10,000 of his own money in the café, he could have earned $1,000 per year in interest by putting the money in a savings account. That amount is an opportunity cost that must be included when calculating economic profit. Thus, the reduction in explicit costs, by not taking out the loan, is offset by the increase in implicit costs of investing his money in the café. John’s economic profit is therefore unaffected. - If John can earn $1000 a year as a recycler, and he likes recycling just as well as running the cafe, how much additional revenue would the cafe have to collect each year to earn a normal profit?

A:

To earn a normal profit, the café would have to cover all its implicit and explicit

costs. The opportunity cost of John's time is $1,000 per year while the café's accounting profit is only $750 per year. Thus, the café would have to earn additional revenues of $250 per year in order for John to make a normal profit. - Explain carefully why, in the absence of a patent, a technical innovation innovation invented and pioneered in one tofu factory will cause the supply curve for the entire tofu industry to shift to the right. What will finally halt the rightward shift?

A:

Without a patent, there is nothing stopping the innovation from spreading across the industry to other firms. As knowledge of the innovation spreads, more firms will make profits, and those profits will catch the attention of more and more outside investors, who will desire to enter the industry. As they enter the industry, the supply curve will shift to the right, which will reduce the price and eventually eliminate the profits generated by the innovation - The city of New Orleans has 200 advertising companies, 199 of which employ designers of normal ability at a salary of $100,000 a year. Paying this salary, each of the 199 firms makes a normal profit on $500,000 in revenue. However, the 200th company employs Janus Jacobs, an unusually talented designer. This company collectors $1,100,000 in revenue because of Jacobs's talent.

- How much will Jacobs earn?

What proportion of her annual salary will be economic rent?

A:

The company that employs Jacobs will collect $500,000 more in revenue than the other advertising companies in New Orleans. Thus, Jacobs will earn $600,000 per year: the normal salary for a designer ($100,000) plus the additional revenue Jacobs generates for the firm that hires her ($500,000). Since Jacobs’ economic rent is $500,000 per year, 5/6 of her salary (roughly 83 percent) is economic rent - Why won't the advertising company for which Jacobs works be able to earn an economic profit?

A:

If the company that employs Jacobs tries to pay her the salary of a normal

designer, the owners of other companies will have an incentive to offer Jacobs a higher salary to bid her away because she generates $500,000 per year in additional revenue for whichever company hires her. In fact, Jacobs' salary will be bid up until no economic profit remains, which occurs when she earns $600,000 per year - Unskilled workers in a poor cotton-growing region must choose between working in a factory for $6,000 a year and being a tenant cotton farmer. One farmer can work a 120-acre farm. which rents for $10,000 a year. Such farms yield $20,000 worth of cotton each year. The total nonlabor cost of pruducing and marketing the cotton is $4,000 a year. A total politician whose motto is "working people come first" has promised that if he is elected, his administration will fund a fertilizer, irrigation, and marketing scheme that will triple cotton yields on tenant farms at no change to tenant farmers

- If the market price of cotton would be unaffected by this policy and no new jobs would be created in the cotton-growing industry, how would the project affect the incomes of tenant farmers in the short run? In the long run?

A:

The short-run economic profit for a cotton farmer is:Economic profit = Total Revenue - Explicit costs – Implicit costsEconomic profit = $60,000 - $14,000 - $6,000Economic profit = $40,000In the long run, more factory workers would want to move into cotton farming, and would thereby bid up the rent on cotton farms. The rent would continue to rise until it reached $50,000 per farm. At that point the incentive to leave a factory job would no longer exist since cotton farmers would again be making zero economic profit. - Who would reap the benefit of the scheme in the long run?

How much would they gain each year?

A:

Landowners would reap the long-term benefits of the scheme. Their income would rise by $40,000 per year per 120-acre plot because rent would rise from $10,000 to $50,000 - The town of Wells has 50 restaurants, 49 of which employ chefs of average ability, who earn $200 per week, which is the usual market price for a chef. Paying this salary, each of these 49 restaurants makes normal profit and collects $1,000 per week in total revenue.

The 50th restaurant employs an unusually talented chef, and collects $1,500 per week in total revenue because consumers are willing to pay more for the meals he cooks. This chef's weekly salary will be:

A:

The restaurant that employs the unusually talented chef will collect $500 more in

revenue each week than the other restaurants in Wells. Thus, the unusually talented chef will earn $700 per week: the usual market price for a chef ($200 per week) plus the additional revenue the chef generates for the restaurant that hires him ($500 per week). - Arguing that many senior citizens have difficulty paying their electric bills, regulators have ordered an electric utility company to change seniors half the rate charged to other customers for each kilowatt-hour of power they use. The normal rates closely mirror the cost of providing power.

- What effect will this have on the seniors' decisions about whether to leave their porch lights on all night?

A:

Lowering the rate that seniors are charged for electricity is equivalent to lowering the price of electricity, leading to an increase in the quantity demanded - What effect will the new regulation have on total economic surplus?

A:

Since normal rates mirror the cost of providing power, if rates are cut in half, the price of electricity will be below the cost of producing it. As a result, seniors will use electricity wastefully and total economic surplus will fall - In the preceding problem, how might regulators have tried to address their policy concern in a more efficient way?

A:

Since the normal rates mirror the cost of providing power, any policy that changes the

price of each kilowatt-hour of power will lower total economic surplus. A more efficient policy would be for regulators to give seniors either a tax break or an income subsidy to help them pay their electric bill. As long as neither the tax break nor the income subsidy depended on the amount of electricity consumed, neither would change in the price of each kilowatt-hour.

沒有留言:

張貼留言