第七章 獨占性競爭與寡占

- 獨占性競爭市場

短期而言,屬於獨佔性競爭的廠商就像是一個獨佔公司一般,可利用部分的獨佔市場力量提高售價以獲取比較高額利潤。

在長期而言,由於競爭者不斷進入,產品的差異化優勢因為競爭而逐漸縮小,市場慢慢變成為類似完美競爭,廠商就無法再獲得過多的經濟利益。

特性: - 買賣人數眾多

- 廠商出售差異性產品,亦即產品雖然不完全相同,但是可以相互替代。

廠商對於產品與其他廠商不同之處具有獨佔性與市場力量,這一點與獨佔市場相同。 - 資訊充分流通

- 廠商可以自由進出

- 差異性產品

是獨占性競爭市場的主要特色

其特點: - 產品外型的差異

生產者可以就產品的包裝、重量、造型、顏色、味道加以設計,使得消費者感到有所不同 - 產品購買的方便性

- 銷售服務

銷售時的服務與售後服務,都可以增加本身產品與其他產品的差異性 - 產品印象

藉著拍廣告來增加消費者心中的印象 - 獨占性競爭的短期分析

追求最大利潤的條件,依然是MR=MC

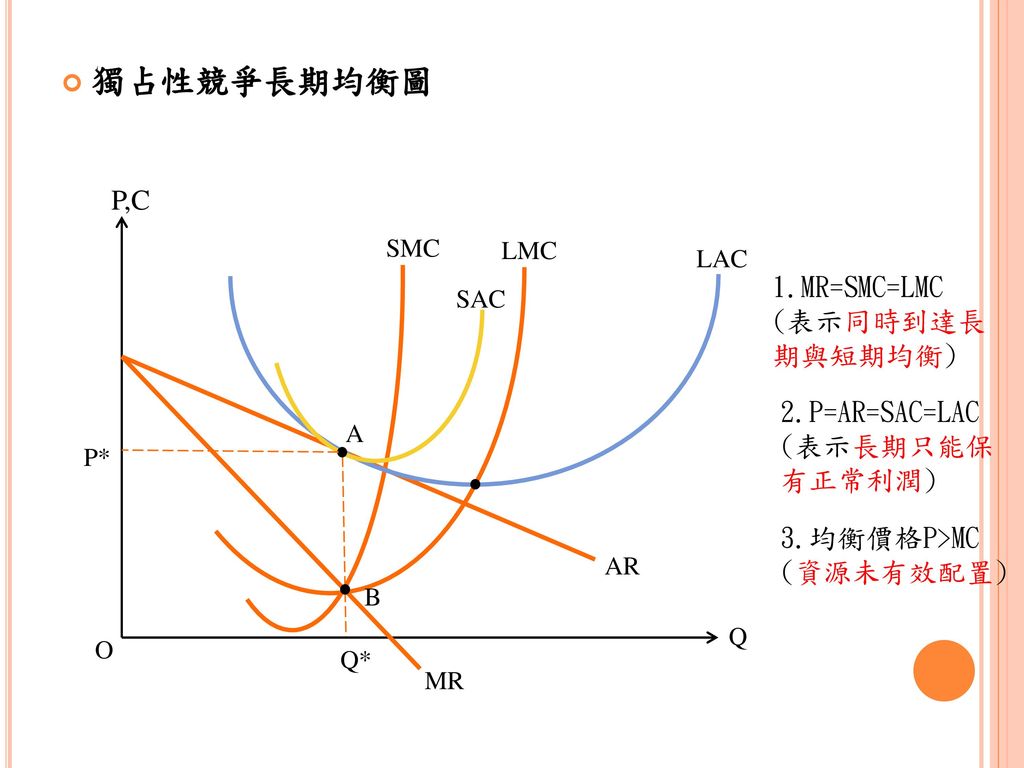

- 獨占性競爭的長期分析

長期均衡的產量取決於MR=SRMC=LRMC

- 短期-超額利潤

不論是以下哪一種情形,超額利潤都會逐漸消失 - 產能擴大-產量增加-產品售價下跌

- 生產要素的需要增加-生產成本的上升

- 短期-虧損

不論是以下哪一種情形,虧損都會逐漸消失 - 產能縮小-產量減少-產品售價上升

- 生產因素的需求減少-生產成本的下降

- 綜合上面情況,獨占性競爭市場在長期之下,超額利潤為0,只有正常利潤。

- 最低生產規模

以短期平均成本線(SRAC)切於長期平均成本線(LRAC)最低點的規模 - 最適生產量

長期平均成本(LRAC)的最低點 - 產能

最低短期平均成本所對應的產量 - 產能過剩

當廠商的產量並未在短期平均成本的最低點 - 獨占性競爭與經濟效率

- 獨占性競爭的價格較完全競爭為高,但是產量卻較低

- 長期之下,獨占性與完全競爭市場的價格都低於SRAC與LRAC,因此長期之下,兩者的超額利潤都為0

- 就資源的使用效率而言,獨占性競爭市場有產能過剩的現象,完全競爭則無

- 廣告

因為差異性產品的特性,獨占性競爭市場特別重視廣告與品牌的形象 - 反對

- 廣告會影響甚至操控個人的嗜好

因為許多廣告比起提供實質的資訊,更重視心理層面的影響 - 廣告會阻礙競爭

認為廣告會強化印象與品牌忠誠度,使得消費者不再重視產品的價格與品質 - 支持

- 廣告可以提供消費者相關資訊

- 廣告也可以強化競爭

廣告提供的訊息讓消費者能做更多比較 - 品牌

- 反對

認為品牌會使人覺得其產品真正與其他學名替代品不同 - 支持

認為品牌代表的是較高的品質

為了維護品牌,生產者會盡力保持一定品質,消費者也會信任品牌保證的產品 - 寡占市場

也叫寡頭壟斷市場,意思是只有少數幾家生產者壟斷著這個市場

特性: - 因為只有少數廠商,所以每一家廠商都有相當程度的獨佔力

- 廠商間具有相互依存性,廠商對於價格的決定,不但要考慮消費者的反應,更要考慮到競爭對手的反應

- 因為寡占產商通常具有相當的規模經濟,形成了其他廠商的進入障礙

- 產品具有同質性或異質性,如水泥(同質性)、汽車(異質性)

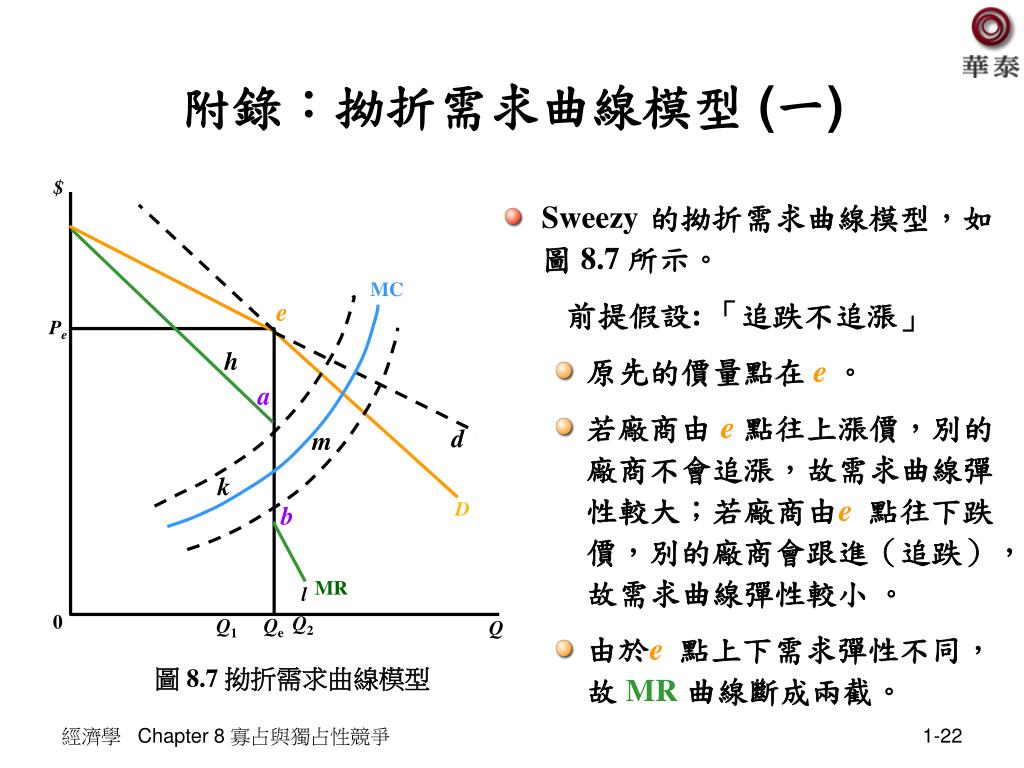

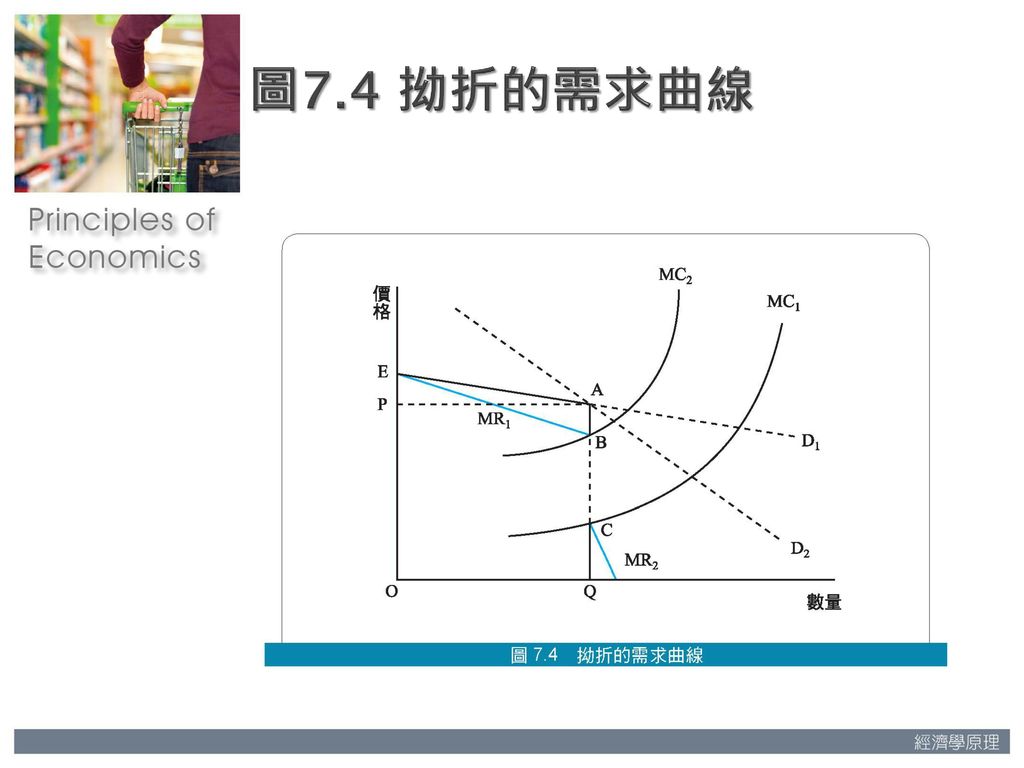

- 拗折的需求曲線理論

- 寡占廠商定價行為的主要特性:

- 每一個寡占場師在定價時,不但是要考慮消費者的反應,更要預期其競爭者可能的反應

- 競爭廠商可能的反應,又取決於競爭廠商對該寡占廠商定價行為的預期

- 史威吉模型的基本假設

- 寡占廠商"跟跌不跟漲"

- 市場已經有一價格p存在

- 史威吉模型的產量與價格的決定

- 在一個假定的固定價格P之下,寡占廠商的行為有兩格特點

- 當該一寡占廠商降低售價時,其他的廠商也會跟進,以避免銷售量的減少

- 當該一寡占廠商提高售價時,其他廠商不會跟進,以期可以增加銷售量

- 符號說明:

- A:一開始決定的P與Q的組合點

- D1,改變售價P時,競爭廠商不動

D2,改變售價P時,競爭廠商隨著跟動

根據假設一,得AD2

根據假設二,得EA

總結,需求線為EAD2 - 當需求曲線為EA,邊際收益線為EB

當需求曲線為AD2,邊際收益曲線為CMR2

總結,邊際收益曲線為EBCMR2 - 根據MR=MC原則,決定產量為Q,價格則為P

在BC線上,邊際成本的變動不影響產量與價格,然礙於各廠商成本結構不同,利潤也不同。

加上"跟跌不跟漲"的心理,因此並不會隨意跟動價格。 - 價格的僵固性

除非需求與成本結構發生重大的改變,否則產量與價格就顯得相當穩定 - 史威吉模型的缺點

- 無法解釋現行價格是如何決定的

其假設與其他市場結構中,價格由供需雙方決定的情況不同 - 有關"跟跌不跟漲"的假設與實證資料不符

如1970年代的停滯性通貨膨脹,就發現與史威吉模型不符的現象 - 資料顯示寡占市場價格變動的頻率較獨佔市場為高,與史威吉模型相反

- 賽局理論與合作經濟學

賽局理論是一套分析策略行為的工具,也就是自己在做決策時,必須將對手可能的行為列入考慮,並且認知到彼此的相互依存關係。 - 賽局的基本要素

- 遊戲規則:在法律範圍內爭取最大利益

- 策略:

- 提高價格、降低價格或維持原價

- 增加產量、減少產量或維持產量

- 增加廣告支出,減少廣告支出

- 報償:利潤或虧損

利潤與虧損的高低取決於需求結構與成本結構,而需求與成本又取決於每一個參與廠商彼此互動的結果 - 結果:

寡占廠商如果獲利當然可以繼續經營下去,如果虧損則考慮退出,等待下一次機會 - 囚徒的困境

賽局理論的非零和賽局中具代表性的例子,反映個人最佳選擇並非團體最佳選擇 - 寡占與囚徒的困境

- Nash均衡

指在包含兩個或以上參與者的非合作賽局(Non-cooperative game)中,假設每個參與者都知道其他參與者的均衡策略的情況下,沒有參與者可以透過改變自身策略使自身受益時的一個概念解

Nash均衡是基於某些對人的行為的假設。例如,所有參賽人皆清楚的了解對手有哪些行動,並且就所有可能的行動中選出一個最適的反應。而這些都是所有人的共同知識(common knowledge)。 - 勾結與卡特爾

因為廠商很少,彼此間會透過勾結來訂定價格與產量,形成進入障礙與提高利潤,如OPEC - OPEC的卡特爾難以維繫

在維持高油價與會員國想提高市佔率之間所有拉扯 - 勾結在各國面臨的困難

- 法律的規定,禁止廠商間的聯合行為

- 執行的困難,因每家成本結構不同,導致售價相同有其難度

- 勾結者的欺騙行為,由於約定沒有約束性,背離約定價格,以求更多利潤所在多有。

- 寡占與經濟效率

為了明白寡占的經濟效率,可以假設上百家的競爭廠商,最後合併成為少數幾家廠商,並比較合併以前與合併以後的廠商行為即可。 - 寡占售價較高

寡占廠商因為相互依存的關係,所以會有一致的公開或秘密的定價行為,產量會較低,售價會較高 - 寡占售價較大

寡占市場因為有進入障礙,所以寡占廠商會有長期利潤。

相較於自由進出的完全競爭市場,利潤會較高。 - 市場型態的比較

----------------------------------------------------------------------------------------

- State whether the following statements are true or false, and explain why

- In a perfectly competitive industry, the industry demand curve is horizontal, whereas for a monopoly it dowward-sloping

A:

False. The industry demand curve is downward-sloping in both cases, but from the individual perfectly competitive firm’s point of view, the demand curve is horizontal. Because the individual firm is too small to affect the market price, it can sell as many units as it wishes at that price - Perfectly competitive firms have no control over the price they charge for their product

A:

True. Perfectly competitive firms are price takers (i.e., if they try to charge a higher price they will lose all their business). Similarly, there is no reason to charge a lower price as they can sell any quantity they choose to at the current price. - For a natural monopoly, average increase as the number of units produced increases over the relevant output range.

A:

True. This is the essential feature of a natural monopoly - Two car manufacturers, Saab and Volvo, have fixed costs of $1 billion and marginal costs of $10,000 per car. If Saab produces 50,000 cars per year and Volvo produces 200,000, calculate the average production cost for each company. On the basis of these costs, which company's marker share do you think will grow in relative terms?

A:

As shown in the following table, Volvo’s greater production volume gives it substantially lower average production cost. This advantage helps explain why Volvo’s market share has, in fact, been growing relative to Saab’s

- A single-price, profit-maximizing monopolist:

- Cause excess demand, or shortages, by selling too few units of a good or service.

- Choose the output level at which marginal revenue begins to increase

- Always charges a price above the marginal cost of production

- Also maximizes marginal revenue

- None of the above statements is true

- If a monopolist could perfectly price-discriminate:

- The marginal revenue curve and the demand curve would coincide

- The marginal revenue curve and the marginal cost curve would coincide

- Every consumer would pay a different price

- Marginal revenue would become negative at some output level

- The resulting pattern of exchange would still be socially inefficient

- What is the socially desirable price for a natural monopoly to charge?

Why will a natural monopoly that attempts to charge the socially optimal price invariably suffer an economic loss?

A:

Socially optimal means that the marginal benefit equals the marginal cost. At this point, all goods that are valuable enough to consumers to justify producing are produced; no goods with costs higher than the benefits they provide are produced. The demand curve tells us about the marginal benefits to consumers: at any given quantity on a demand curve, the price that inspires that quantity demanded is equal to the marginal benefit of the good. Therefore, setting marginal benefit equal to marginal cost requires setting a price that’s equal to marginal cost, and selling to all consumers who demand it at that price. However, this is not a good outcome for natural monopolies, which are usually characterized by very large fixed costs and relatively low marginal costs. The high fixed costs mean that average cost is greater than marginal cost, so that charging a price equal to marginal cost implies economic losses - Explain why price discrimination and the existence of slightly different

variants of the same product tend to go hand in hand. Give an example from your own experience

A:

If a firm wishes to price discriminate, it needs to be able to identify and separate consumers that are willing to pay more from consumers that have a lower willingness to pay. This is a profit-increasing strategy for the firm. Often, in order to separate customers, some minor differences are incorporated into the product that will appeal to customers with a higher willingness to pay, and then a higher price is charged for this slightly different product. For example, a well-known mail-order firm sells down-filled comforters with a plain stitch pattern at a lower price than slightly warmer comforters with a fancier stitch pattern. The price differential is about 100 percent - TotsPoses, Inc., a profit-maximizing business, is the only photography business in town that specializes in portraits of small children. George, who owns and runs TotsPoses, expects to encounter an average of eight customers per day, each with a reservation price shown in the following table

- If the total cost of each photo portrait is $12, how much should George charge if he must

charge a single price to all customers? At this price, how many portraits will George produce

each day?How much economic profit will he earn?

A:

George’s total and marginal revenue:

Since marginal cost equals $12, George will set a price consistent with serving only the first five customers. That price is the reservation price of the fifth customer, $34. His profit will equal his total revenue minus his total cost, or ($34 × 5) – ($12 × 5) = $170 - $60, or $110 per day - How much consumer surplus is generated each day at this price?

A:

Consumer surplus = ($50 + $46 + $42 + $38 + $34) - ($34 × 5), or $40 per day - What is the socially efficient number of portraits?

A:

The socially efficient number of portraits is 8, since each customer has a reservation price that exceeds the marginal cost of production - George is very experienced in the business and knows the reservation price of each of his

customers. If he is allowed to charge any price he likes to any consumer, how many portraits

will he produce each day? How much economic profit will he earn?

(Assume the cost of each photo portrait is still $12)

A:

George will produce 8 portraits, and his economic profit will be ($50 + $46 + $42 + $38 + $34 + $30 + $26 + $22) - ($12 × 8), or $192 per day - In this case, how much consumer surplus is generated each day?

A:

No consumer surplus will be generated since each customer is paying a price equal to his/her reservation price - Refer back to Problem 7 and answer the following questions.

- Suppose George is permitted to charge two prices. He knows that customers with a

reservation price above $30 never bother with coupons, whereas those with a reservation price of

$30 or less always use them. At what level should George set the list price of a portrait? At what

level should he set the discount price? How many photo portraits will he sell at each price?

A:

The ability to offer a rebate coupon allows George to divide his market into two submarkets. The table of total and marginal revenue for the list price submarket is as follows:

George should set the price at $34 and sell 5 photos per day in this market, since for each of these 5 customers marginal revenue is greater than or equal to marginal cost. In the discount-price submarket, the table of total and marginal revenue is as follows:

The discount price should be $22 and George should sell 3 photos in this market, since for each of these 3 customers (customer number 6, 7, and 8) marginal revenue is greater than or equal to marginal cost - In this case, what is George's economic profit and how much consumer surplus is generated

each day?

A:

George’s economic profit is now ($34 × 5) + ($22 × 3) – ($12 × 8), or $140. Consumer

surplus is [($50 + $46 + $42 + $38 + $34) - ($34 × 5)] + [($30 + $26 + $22) - ($22 × 3)], or $52 - Beth is a second-grader who sells lemonade on a street corner in your neighborhood. Each cup of lemonade costs Beth 20 cents to produce; she has no fixed costs. The reservation prices for the 10 people who walk by Beth’s lemonade stand each hour are listed in the table below. Beth knows the distribution of reservation prices (that is, she knows one person is willing to pay $1.00, another $0.90, and so on), but she does not know any specific individual’s reservation price

- Calculate the marginal revenue of selling an additional cup of lemonade. (Start by figuring out

the price Beth would charge if she produced only one cup of lemonade, and calculate the total

revenue; then find the price she would charge if she sold two cups of lemonade; and so on.)

A:

See 3rd and 4th rows of the table below.

- What is Beth’s profit maximizing price and quantity?

A:

Beth maximizes her profit by producing at the level of output at which marginal revenue is equal to marginal cost. This occurs at a price of $0.60. The corresponding quantity sold is 5 cups of lemonade - At that price, what are Beth’s economic profit and total consumer surplus?

A:

Profit equals total revenue minus total cost. Since Beth has no fixed costs, at a price of

$0.60, her profit equals (5 × $0.60) - (5 × $0.20) = $2 per day.

Total consumer surplus in Beth’s lemonade market is found by adding together the price each consumer is willing to pay minus the price they actually pay.

Total consumer surplus = ($1 - $0.60) + ($0.90 - $0.60) + ($0.80 - $0.60) + ($0.70 - $0.60) = $1 per day - What price should Beth charge if she wants to maximize total economic surplus?

A:

Total economic surplus is maximized when price is equal to marginal cost. In this market, marginal costs are constant at $0.20 per cup - Now suppose Beth can tell the reservation price of each person. What price would she charge

each person if she wanted to maximize profit? Compare her profit to the total surplus calculated

in 9d.

A:

She would charge persons A through I their respective reservation prices. Doing so would earn her a profit of $3.60, which is the same as the total economic surplus in part d. Note the total economic surplus is maximized in both this problem and part d, but the distribution of the surplus is different

The monopolist chooses the output level at which marginal revenue equals marginal cost and then charges a price consistent with demand at that level of output. Since price always exceeds marginal revenue, price is greater than marginal cost. The quantity produced by the monopolist at the monopoly price is exactly equal to the quantity demanded by consumers, so the monopolist does not cause excess demand or shortages (even though the monopolist’s profit-maximizing level of output falls below the socially efficient level). And the monopolist has no reason to maximize marginal revenue (which would require producing zero units of output).

The answer is a. The demand curve and the marginal revenue curve would coincide, because if a monopolist could perfectly discriminate, it would sell each successive unit of output for exactly its reservation price, so the marginal revenue generated from selling each successive unit would equal its reservation price.

沒有留言:

張貼留言