第九章 資訊與經濟

- 資訊不對稱與資訊不完整

- 資訊的重要性

消費者與生產廠商都是依據預期的成本-效益分析做決策 - 資訊不完整的影響

如對產品瞭解不盡然,導致的虧損 - 資訊不對稱的影響

擁有更多資訊的一方,在交易上較占優勢 - 資訊不對稱或不完整所產生的成本

- 搜尋成本

取得有關產品品質、項目所花的成本,是尋找有利交易機會的成本 - 談判成本

因買賣談判而產生的成本,談判成本包括討價還價有關的一切成本 - 執行成本

保證對方履行契約義務的成本 - 代理問題

代理人未提供充分資訊給委託人,或是對委託人有意隱瞞某些重要的資訊,因而衍生出資訊不對稱問題,使得市場價格機能扭曲,導致市場失靈。 - 經紀人的角色

- 經紀人的意義

其意義在於組織市場、提供可能交易機會的資訊、促進交易的完成。

經紀人(或稱中間商、仲介)的存在可以降低交易成本 - 資訊不對稱實例

- 逆向選擇與道德危險的不同

- 逆向選擇

交易的同時,一方擁有較另一方更多的資訊,因而使得對方處於不利的地位。 - 道德危險

交易完成後,交易的一方改變其作法,使得另一方處於不利的地位

如故意受傷來賺保費 - 逆向選擇與"檸檬"市場

逆向選擇會降低交易量與市場經濟效率,導致市場失靈 - 降低汽車市場的逆向選擇

以汽車市場為例,新車會以保證書,舊車會以自己的聲譽作為擔保,獲取買主的信任,來降低逆向選擇 - 保險市場的資訊不對稱與逆向選擇

要保人對自己的狀況,比保險公司來得清楚。

因此,保險公司會要求要保人提出自身的資訊,另外團體保險也可以避免逆向選擇 - 降低保險市場的道德危險

保險公司會以共保或是扣除額的做法來降低,使得投保者不會因為有保險就恣意妄為。 - 扣除額

某一金額內的損失,保險公司不負責理賠 - 共保

保險公司與要保人共同負擔損失 - 金融市場的逆向選擇與道德危險

- 降低金融市場的逆向選擇與道德危險

我國會設立證期會,負責監督管理各上市公司,並且規定上市公司要有公開說明會,來降低逆向選擇與道德危險。 - 勞動市場的逆向選擇與道德危險

- 效率工資

將工資定在均衡工資以上,使工人少偷懶 - 年功俸

對於資深者給予較高的薪資或更好的福利,跟效率工資的目的相同。 - 利潤分享

員工可以分享公司獲利的結果 - 生活中的風險

- 個人對風險的態度

- 關心報酬的大小

- 公平賭局,平均貨幣報酬為0

- 不利賭局,平均貨幣報酬為負

- 有利賭局,平均貨幣報酬為正

- 關心風險(亦即報酬變動幅度)的大小

- 風險趨避、風險中立與風險愛好

- 風險中立

指參與賭局者只關心平均報酬是否為正 - 風險趨避

指參與賭局者會拒絕一個公平賭局,亦即拒絕平均報酬為零的賭局 - 風險愛好

指參與賭局者會參與即使是不利的賭局,亦即平均報酬為負時,也願意加入 - 例:保險與風險

- 不參加保險的情形

500.000的房子,10%的機率損毀,平均而言,你擁有房子的價值為450.000 - 參加保險的情形

保費100.000,平均而言,你擁有房子的價值為400.000 - 兩相比較

因為平均報酬為負,因此只有風險趨避者會接受此種保險

-----------------------------------------------------------------------------------

- For each good listed below, discuss whether the good is likely to entail either an external cost or an external benefit. In addition, discuss whether the private market is likely to provide more or less than the socially optimal quantity of the good.

- Vaccinations

A:

Vaccinations entail benefits to people other than those who are vaccinated because people who are vaccinated against infectious diseases are less likely to contract those diseases and pass them on to others. Private markets tend to provide less than the socially optimal quantity of goods that entail external benefits. - Cigarettes

A:

Cigarettes entail costs to people other than those who smoke because second-hand smoke has been shown to be harmful to people's health. Private markets tend to provide more than the socially optimal quantity of goods than entail external costs - Antibiotics

A:

On one hand, antibiotics entail an external benefit because a person who takes an antibiotic will be less likely to pass his or her bacterial infection on to others. One the other hand, antibiotics also entail an external cost because bacteria often develop resistance to antibiotics and become less effective as more people use them. Whether private markets provide more or less than the socially optimal quantity of antibiotics depends on whether you think their external costs outweigh their external benefits - Suppose the law says that Jones may emit smoke from his factory unless he gets permission from Smith, who lives downwind. If the relevant costs and benefits of filtering the smoke from Jones’s production process are as shown in the following table, and if Jones and Smith can negotiate with one another at no cost, will Jones emit smoke?

A:

The most efficient outcome is for Jones to emit smoke, because the total daily surplus in that case will be $600, compared to only $580 when Jones does not emit smoke. Since Smith has the right to insist that Jones emit no smoke, Jones will have to compensate Smith for not exercising that right. If Jones pays Smith $30, each will be $10 better off than if Smith had allowed Jones not to emit smoke. - John and Karl can live together in a two-bedroom apartment for $500 per month, or each can rent a single-bedroom apartment for $350 per month. Aside from the rent, the two would be indifferent between living together and living separately, except for one problem: John leaves dirty dishes in the sink every night. Karl would be willing to pay up to $175 per month to avoid John’s dirty dishes. John, for his part, would be willing to pay up to $225 to be able to continue his sloppiness.

- Should John and Karl live together? If they do, will there be dirty dishes in the sink? Explain.

A:

John and Karl stand to save $200 per month in rental payments by living together since their total rent is $500 when they share and $700 when they each rent their own apartment. The question is whether this benefit justifies their living together despite John's objectionable habit of leaving his dirty dishes in the sink. The lowest-cost accommodation to the dirty-dish problem is for John to leave his dirty dishes in the sink. In this case, the maximum monthly rent Karl would be willing to pay to share an apartment with John is $350 - $175 = $175 per month. This amount would leave John with a remaining monthly rent bill of $325, which generates a social surplus of $25 per month. If John splits this surplus evenly with Karl, John ends up paying $337.50 per month and Karl pays $162.50 per month. Both John and Karl will therefore be better off living together - If John would be willing to pay up to $30 per month to avoid giving up his privacy by sharing quarters with Karl? Should John and Karl live together?

A:

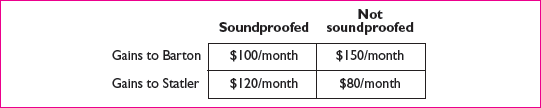

Adding an additional $30 per month to the cost of the shared living arrangement makes the total cost of sharing $205 per month. Because that amount exceeds the $200 per month that John and Karl save by living together, they should live separately - Barton and Statler are neighbors in an apartment complex in downtown Manhattan. Barton is a concert pianist, and Statler is a poet working on an epic poem. Barton rehearses his concert pieces on the baby grand piano in his front room, which is directly above Statler’s study. The following matrix shows the monthly payoffs to Barton and Statler when Barton’s front room is and is not soundproofed. The soundproofing will be effective only if it is installed in Barton’s apartment.

- If Barton has the legal right to make any amount of noise he wants and he and Statler can negotiate with one another at no cost, will Barton install and maintain soundproofing? Explain. Is his choice socially efficient?

A:

Barton will not install and maintain soundproofing. Barton’s monthly payoff without soundproofing is $50 more than with it, so his natural inclination is not to install soundproofing. Statler would have to pay Barton at least $50 to induce Barton to install soundproofing, but since soundproofing is worth only $40 per month to Statler, Statler will not be willing to pay Barton $50 to install the soundproofing. Since the joint payoff is $230 without soundproofing and $220 with it, their choice to not install soundproofing is socially efficient - If Statler has the legal right to peace and quiet and can negotiate with Barton at no cost, will Barton install and maintain soundproofing? Explain. Is his choice socially efficient?

A:

Barton will not install soundproofing and this choice is socially efficient. In this case, he will pay Statler $40 per month to compensate him for the noise he makes while practicing - Does the attainment of an efficient outcome depend on whether Barton has the legal right to make noise, or Statler the legal right to peace and quiet?

A:

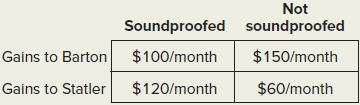

Either way, the efficient outcome (no soundproofing) is reached. The difference is that when Barton has the right to make as much noise as he wants, his monthly payoff is higher than when Statler has the legal right to peace and quiet. Similarly, Statler’s monthly payoff is higher when he has the legal right to peace and quiet than when Barton has the right to make as much noise as he wants - Refer to Problem 4. Barton decides to buy a full-sized grand piano. The new payoff matrix is as follows:

- If Statler has the legal right to peace and quiet and Barton and Statler can negotiate at no cost, will Barton install and maintain soundproofing? Explain. Is this outcome socially efficient?

A:Barton will now install and maintain soundproofing, because doing so is cheaper than compensating Statler at a rate of $60 per month for the noise nuisance. This outcome is socially efficient - Suppose that Barton has the legal right to make as much noise as he likes and that negotiating an agreement with Barton costs $15 per month. Will Barton install and maintain soundproofing? Explain. Is this outcome socially efficient?

A:

Barton will not install soundproofing in this case. The noise costs Statler $60 per month, so in the absence of transaction costs Statler would be willing to pay up to that amount to induce Barton to install soundproofing. However, if Statler must also pay a $15 fee for this transaction, it is not worthwhile. Thus, no soundproofing will be installed, and the outcome will be socially inefficient - Suppose Statler has the legal right to peace and quiet, and it costs $15 per month for Statler and Barton to negotiate any agreement. (Compensation for noise damage can be paid without incurring negotiation cost.) Will Barton install and maintain soundproofing? Is this outcome socially efficient?

A:

If Statler has the legal right to peace, then installing and maintaining the soundproofing will be cheaper for Barton than to pay Statler $60 per month compensation for noise damage. In this case, the outcome is socially efficient - Why does the attainment of a socially efficient outcome now depend on whether Barton has the legal right to make noise?

A:

When negotiation is costly, the Coase theorem does not guarantee that private parties will arrive at the socially efficient outcome. Thus, the attainment of the socially efficient outcome will depend on who has the legal right to perform the activity that generates the externality - Determine whether the following statements are are true or false, and briefly explain why:

- A given total emission reduction in a polluting industry will be achieved at the lowest

possible total cost when the cost of the last unit of pollution curbed is equal for each firm

in the industry

A:

[Note: This question should really be moved to Chapter 10. Your students may have difficulty answering the question within the context of this chapter.]

True. Suppose that the marginal cost of emission reduction for plant A is higher than that in plant B. That means that we can reduce the total cost by allowing plant A to pollute more (since the marginal cost will fall) and ordering plant B to reduce its emissions further (since the marginal cost will rise.) We can do this until the marginal cost of emission reduction is the same at the two plants - In an attempt to lower their costs of production, firms sometimes succeed merely in

shifting costs to outsiders

A:

True. An example is the excessive use of pesticides on crops. This activity reduces the amount of insect damage to crops, and thus lowers the farmer’s production cost. However, the pesticide runoff pollutes waterways, imposing a negative externality on recreational users of those waters - A village has six residents, each of whom has accumulated savings of $100. Each villager can use this money either to buy a government bond that pays 15 percent interest per year or to buy a year-old llama, send it onto the commons to graze, and sell it after 1 year. The price the villager gets for the 2-year-old llama depends on the quality of the fleece it grows while grazing on the commons. That in turn depends on the animal’s access to grazing, which depends on the number of llamas sent to the commons, as shown in the following table:

The villagers make their investment decisions one after another, and their decisions are public. - If each villager decides individually how to invest, how many llamas will be sent onto the commons, and what will be the resulting net village income?

A:

The table below shows the total village income from grazing llamas as well as the marginal village income from the activity:

If each villager decides individually how to invest, then the villagers will continue to send llamas onto the commons as long as the income each earns from doing so is greater than $15, the amount a villager could earn from buying a government bond. Thus, from the information in the "Income per llama" column in the table above, we can see that 3 llamas will be sent onto the commons. The resulting net village income will be $48 from the llamas plus $45 from government bonds, or $93 - What is the socially optimal number of llamas for this village? Why is that different from the actual number? What would net village income be if the socially optimal number of llamas were sent onto the commons?

A:

A llama should be sent onto the commons if and only if its marginal contribution to total village income is greater than $15, the amount a villager could earn from buying a government bond. Thus, the socially optimal number of llamas on the commons is 1. When the villagers decide individually how to invest, they send 3 llamas, rather than just 1, because in deciding whether or not to send a llama each villager ignores the negative impact of his or her llama’s presence on the other llamas’ fleece quality. Total village income with 1 llama on the commons is $22 from the llama plus $75 from government bonds, or $97 in total - The village committee votes to auction the right to graze llamas on the commons to the highest bidder. Assuming villagers can both borrow and lend at 15 percent annual interest, how much will the right sell for at auction? How will the new owner use the right, and what will be the resulting village income?

A:

If a single villager could control access to the commons, she would send only a single llama onto the commons, which she could sell after one year for $22 more than she paid for it. If the land were free, the owner would thus earn $22 per year by raising one llama per year on it, or $7 more than she would have earned had she used her $100 to buy a bond. The price of the land will be bid up until owning the land is no better than putting the same amount in the bank at 15 percent interest. That price is the amount of money, X, that would yield $7 per year if deposited at 15 percent interest: 0.15X = $7, or X = $46.67. The new owner will graze one llama. Total village income will be the same as in part b - Suppose that Lance and Jan are the two top cyclists in the world. Both are scheduled to compete in an upcoming cycling competition in which the winner will receive $100,000 in prize money while the rest of the competitors receive nothing. Both cyclists are very talented, but they can increase their chances of winning by doping (i.e., taking performance-enhancing drugs). The cost to each of doping is $25,000 (this includes not just the cost of the drugs, but also both the health costs and the expected damage to their reputations if they are caught). Each has a 50 percent chance of winning the race either if both of them dope or if neither of them dopes. On the other hand, if only one of them dopes, then the one who dopes will win the race for sure.

- Discuss whether this situation involves a positional externality.

A:

Since each cyclist's payoff depends on his relative performance, any step either takes to improve his performance will necessarily lower the expected payoff of the other - Write down the expected payoff matrix for this game, assuming that both Lance and Jan make their decisions simultaneously.

A:

See below. To see how the numbers in the table were calculated, note that, for example, when both Lance and Jan dope, each has a 50 percent chance of winning, so both Lance and Jan have an expected payoff of (0.50 × $100,000) - $25,000, or $25,000

- Will the outcome of this game be socially optimal? Explain.

A:

Note that this game is a prisoner's dilemma. For both Jan and Lance, doping is a dominant strategy. Yet when both dope, each gets an expected payoff of only $25,000. Each would have had an expected payoff of $50,000 if they both did not dope

沒有留言:

張貼留言