第十章 總體經濟學導論

- 總體經濟與個體經濟的關係

總體經濟學是研究整個經濟運作的一門學問,著重整個經濟體系的產出水準、產出變動、物價水準的變化、失業情形等 - 總體經濟分析與"其他條件不變"

個體經濟學探討的是經濟體系中相對較少的部分,至於不是討論的部分,都當作已知看待

總體經濟學探討的是整體經濟問題,或是經濟體系中很大的部分,因此不能假設其他條件不變 - 總體變數相互影響

- 抵銷效果

政府的總體經濟政策之間,很容易產生效果相互抵消的情形

如政府對稅賦的改變,對整體的就業產生相互抵消的效果 - 反饋效果

反饋效果就是可以增強直接效果的間接效果

如政府增稅→失業增加→製造業產品需求降低→失業再度增加 - 加總

總體經濟學關心整個社會的供給(總合供給Aggregate supply)、需求(總合需求aggregate demand)、物價水準(物價指數)、總產出(total output)

而不是一個產品的供給、需求、價格與產量

所謂的加總就是將相同的變數加在一起,如將各行各業的失業人口加總來了解整個社會的失業人口 - 國內生產毛額的衡量

- 國內生產毛額的要素

國內生產毛額(gross domestic product)是指一個國家之內,在一年之內所生產最終財貨與勞務市場價值的總和。 - GDP是市場價值,將所有的財貨與勞務轉換成市場價格

- GDP包括經濟體系所生產與銷售的所有財貨與勞務

- GDP只包括最終產品的價值

只計算最終產品,是因為中間財的價值已經包括在最終財貨裡面 - 最終產品是直接消費的產品

- 中間財是用來生產其他產品的零件或材料等

- GDP包括有形的財貨與無形的勞務

- 有形的財貨,為食物、衣服、汽車、電腦等

- 無形的勞務,為理髮、房屋清潔、醫生看病等

- GDP包括當期所生產的,不包括過去生產在當期銷售的

如新車能算進GDP,而二手車不能算入 - GDP是發生在國內生產的價值才要列入,如印尼勞工在台灣的生產屬於台灣的GDP,台商在中國的生產屬於中國的GDP

- GDP衡量的是經濟體系在該一時間內所得或收入與支出的流動

- GDP的組成

- 民間消費,C

民間消費是指家庭對財貨與勞務的支出,購買房子的支出不算入民間消費

如汽車、醫療、教育等 - 投資,I

投資是資本存量的增加,亦即對資本設備的購買,用以生產更多可供未來使用的財貨與勞務,包括對資本設備、存貨以及一些結構上的購買

如買新屋 - 政府支出,G

政府支出包括消耗性的支出與投資性的支出,消耗性的支出是為政府公務員的薪資,投資性的支出為政府從事各種公共建設工作

*老人津貼是移轉支出(transfer payment),雖然可以增加貧窮家庭收入,卻與生產無關,因此不算入GDP - 淨出口,NX

出口值減去進口值以後的淨額 - 公式:

Y(GDP)=C+I+G+NX - GNP與GDP

GNP是指一國"國民"在一定期間內,所生產最終財貨與勞務市場價值的總和。 - 國民指的是常住人口,亦即在一國之內住達半年以上的人,並未考慮他的國籍

- GNP=GDP-外國人在本國的所得+本國人在國外所得

- 實質GDP與名目GDP

GDP也能表示一國之內一年的總支出(Gross domestic expenditure, GNE) - 實質GDP是將某年(當期)所生產財貨與勞務,以過去某一年(基期)的價格來計算的結果

其因為將價格固定在基期,反應的只有生產的數量 - 名目GDP是以當期價格(Current price)計算的GDP

其反應的是一個經濟體系所生產財貨與勞務的價格與數量 - 國民所得平減指數(The GDP deflator)

反應的是生產出來財貨與勞務的價格,而不是生產的數量 - 公式

國民所得平減指數=名目GFP/實質GDP*100 - 國民所得平減指數衡量當期價格相對於基期價格的變動

- 當價格固定但是產出數量改變的情形

在此情形時,名目GDP與實質GDP同時增加,所以國民所得平減指數不變 - 考慮數量不變但價格上漲的情形

此時名目GDP增加,實質GDP不變,所以國民所得平減指數也隨之增加 - 國內生產毛額的支出面與收入面

- 國內生產毛額的支出面

根據GDP的定義,不是最終財貨與勞務的支出,就不應列入當年的GDP,如中間財、舊貨的買賣、金融資產、交易與移轉支付 - 舊貨的買賣

舊貨的買賣不包括在GDP之內,是因為這些物品在當初生產時,就已經列入當年的GDP - 金融資產

金融資產(股票與債券)的買賣,只是所有權的轉移,不應列入當年的GDP - 交易與移轉支付

- 政府的移轉支付

是政府對民間私人的無償贈與,包括社會安全給付、失業保險給付與各項社會福利給付 - 私人的移轉支付

私人或私人團體間的贈予行為,與當年生產無關,所以不列入 - 國內生產毛額的收入面

GDP應包括工資、地租、利息、利潤。而這四種的總和是因素成本的淨產出

收入面的GDP=工資+地租+利息+利潤+(企業間接稅-補貼)+折舊 - 因素成本的淨產出要再經過調整才會和支出面的GDP相等

- 從因素成本調整為市場價格

企業間接稅(如銷售稅)和補貼是使得支出面與收入面有所差異的原因

銷售稅使得市場價格大於因素成本

補貼則使得因素成本大於市場價格

所以要調整使得支出面與收入面的GDP相等,我們必須將因素成本的淨產出加上企業間接稅,再減去補貼 - 從淨產出調整為總產出

支出面的GDP衡量的是總產出,但是收入計算的是淨產出

折舊(depreciation)是主要的差異,折舊是資產價格隨著時間的經過呈現遞減現象,所以從收入面計算GDP,必須加上折舊 - 各種國民所得之間的關係

- 國內生產毛額

從生產面、支出面、收出三個角度,都應該相等 - 國內生產淨額(net domestic product, NDP)

從事生產都會有機器設備、廠房的折舊,所以將GDP減去折舊以後的淨額就是國內生產淨額

NDP=GDP-折舊 - 國內要素所得(factor income)

國內要素所得是真正為各種生產要素所得的總和

企業間接稅不是對生產要素的報酬,其雖然可以增加政府的收入,卻不構成個人收入的來源

國內要素所得=GDP-折舊-間接稅淨額 - 個人所得(personal income, PI)

個人所得=國內要素所得-(利事業所得稅+公司未分配盈餘+政府財產或企業所得)+(政府的移轉支付+公債利息) - 個人可支配所得(disposal income, DI)

DI=PI-個人所得稅

DI=當期消費+儲蓄(可看成是未來消費)

因為我們不是消費就是儲蓄 - GDP與經濟福祉

- GDP的一些缺失

- 忽略人口的因素

一個國家整體的GDP可能很高,但是人口更多,以至於每人GDP降低 - 無法反應所得分配

以經濟的觀點,所得分配平均較所得分配不均為佳,但是GDP的數字無法反應這一點 - 非市場交易的財貨與勞務無法列入

家庭勞動自己做不會被列入,花錢請人做就會被列入,就會低估GDP - 地下經濟未列入GDP之中

因為是非法活動,所以無法取得明確數字,也就使得這些活動造就的經濟福祉降低,無法被記入GDP之中 - 地下經濟

指未向政府機關報告的經濟行為 - 休閒價值被忽略

國民所得高與人民福祉不一定成正比,現代對休閒較以往都來得重視 - 公害被忽略

有時GDP的增長,是用環境破壞換來的,進一步降低人民生活品質,這些都是GDP無法考量的 - 無法反應產品品質的改善

同樣價格的產品,十年前與現在都貢獻相同的GDP,但產品品質與功能卻天差地別。 - 無法做國際間的比較

每個國家對統計資料的詳實不一,且列入GDP的因素也略有差別 - 每人GDP的重要性

每人GDP雖然無法直接衡量那些對生活福祉有價值的東西,卻可以衡量使我們生活福祉提高的能力。

第十一章 物價與生活成本的衡量

- 物價指數

- 生產者物價指數(producer price index, PPI)、批發物價指數

生產者所生產產品的加權平均價格

計算PPI,採用的是出廠價 - 消費者物價指數(consumer price index, CPI)、零售物價指數

一個四口之家的都市家庭,所購買物品的加權平均價格

CPI可以用做人們生活成本的指標,通貨膨脹率也是指CPI的變動率

計算CPI,採用的是零售價 - 國民所得平減指數(隱性的物價指數 implicit price index)-GDP deflator

名目GDP/實質GDP

-反映了通膨率的大小,表達了貨幣供給量與貨幣需求的比例關係 - 消費者物價指數

- 如何閱讀CPI的數字

- 基期(base year)

作為比較的基礎年,其CPI為100

如A年的CPI為100,A+10年為109.68,意味著這10年間,物價上漲9.68% - 建構消費者物價指數

計算的五步驟 - 固定一籃的產品

找出那些價格變動與消費者息息相關的產品 - 找出相關的價格

將各種與民生相關的產品找出以後,接著找出其價格 - 計算出成本

計算出相同的一籃產品,在不同時期的成本為若干 - 選擇基期與計算指數

選擇某年為基期,他年為當期(current year)

CPI=(當期一籃產品的價格/基期一籃產品的價格)*100 - 計算通貨膨脹率

利用CPI來計算第T年通貨膨脹率

(CPI,t-CPT,t-1/CPT,t-1)*100 - 消費者物價指數與生活成本

CPI計算的目的,就是要衡量消費者如果要維持相同的生活水準時,所需要的貨幣量

但因為CPI沒有列入所有與生活有關的產品,也沒有列入產品增加的數量,以及某些計算偏誤,使得CPI無法真正衡量生活成本 - CPI計算時偏誤的來源

- 新產品的偏誤

CPI的產品組成沒有隨時變動,無法真正反應消費習慣的改變 - 品質改變的偏誤

價格的上升伴隨品質的上升,卻常被當作通貨膨脹 - 產品替代的偏誤

A產品價格的上漲,使得人們購買B產品做為替代,CPI僅顯示A的產品較高,B產品較低,沒有顯示人們以B產品做為A產品的替代現象。 - CPI偏誤的影響

- 私人契約的扭曲

CPI因為無法真正反應生活成本,必須要加以修正,薪資契約才可能隨之變動,但此種調整可能花費的成本太高。 - 增加政府支出

政府的公務人員薪資、福利支出,也會將CPI的因素納入考慮 - 國民所得平減指數

GDP,current year=IPD*GDP,base year - 名目價值與實質價值

- 名目工資與實質工資

- 名目工資(貨幣工資)

當期價格所算出來的工資

名目工資的改變包括單位時間內的生產所能購買的產品數量,以及物價水準的改變 - 實質工資

以某一基期價格所計算出來的工資

實質工資,year=(名目工資,year/CPI,year)*100

實質工資的改變是衡量工人在單位時間內的生產,所能購買的產品數量 - 名目利率與實質利率

通貨膨脹率越高時,購買力越低,如果通貨膨脹率大於利率時,購買力反而會下降

實質利率=名目利率-通貨膨脹率 - 名目利率

銀行、報章雜誌的利率 - 實質利率

經過通貨膨脹率修正過後的利率

-----------------------------------------------------------------------------

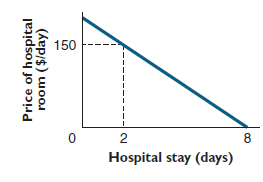

- In the event he requires an appendectomy, David’s demand for hospital accommodations is as shown in the diagram. David’s current insurance policy fully covers the cost of hospital stays. The marginal cost of providing a hospital room is $150 per day.

- If David’s only illness this year results in an appendectomy, how many days will he choose to stay in the hospital?

A:

With full coverage, the marginal cost to David of staying in the hospital is zero, so he

will stay until the marginal benefit of staying in the hospital is zero, or 8 days. This choice fails the cost-benefit test because the marginal benefit of the 8th day in the hospital ($0) is less than its marginal cost ($150). - How many days would David have chosen to stay in the hospital if his insurance covered only the cost of hospital stays that exceed $1,000 per illness?Explain why that choice would have failed to satisfy the cost-benefit test.

A:

Since David will have to pay $150 per day for any hospital stay that costs less than $1,000 he will choose to stay in the hospital 2 days - Dave's willingness to pay for hospital recovery time following his upcoming is $300 for the first day, $200 for the second, $100 for the third, $50 for the fourth, and nothing for days beyond four,

- If Dave is uninsured and the cost of providing a hospital room is $250 per day, how many days will he stay in the hospital following his operation?

A:

Dave would stay only one day since his willingness to pay for the second day ($200) is less than the cost of the second day ($250) - How many days would he stay if his insurance covered half the cost of each hospital day?

A:

If Dave’s insurance covers half of the cost of each hospital day, he would pay $125 a day. Thus, Dave would choose to stay two days since his willingness to pay for a third day ($100) is less than $125 - Describe a change in the terms of his insurance policy that would benefit both Dave and his insurer.

A:

Examples may vary. One possibility is if Dave’s insurance stops covering hospital stays and instead reduces the cost of his health insurance by $225 - Two firms, Sludge Oil and Northwest Lumber, have access to five production processes, each one of which has a different cost and gives off a different amount of pollution. The daily costs of the processes and the corresponding number of tons of smoke emitted are as shown in the following table:

- If pollution is unregulated, which process will each firm use, and what will be the total daily smoke emission?

A:

If pollution is unregulated, both firms will use process A and emit 8 tons per day - The City Council wants to curb smoke emissions by 50 percent. To accomplish this, it requires each firm to curb its emissions by 50 percent. What will be the total cost to society of this policy?

A:

To reduce emissions by 50 percent, both firms must switch to process C. The cost will be $120 - $50 = $70 for Sludge Oil and $500 - $100 = $400 for Northwest Lumber, for a total cost of $470 - The City Council again wants to curb emissions by half. This time, it sets a tax of $T per day on each ton of smoke emitted. How large will have to be to effect the desired reduction? What is the total cost to society of this policy?

A:

Each firm will switch to a cleaner process if the cost of doing so is less than $T. If T = $81, Sludge Oil finds it worthwhile to switch from process A to B, and still finds it worthwhile to switch from process B to C, and again from C to D. Northwest Lumber finds it worthwhile to switch from process A to B. Sludge Oil thus cuts emissions by 3 tons, and Northwest Lumber by 1 ton. The total cost to society is $200 - $50 + $180 - $100, or $230 - Refer to Problem 3. Instead of taxing pollution, the city council decides to auction off four permits, each of which entitles the bearer to emit 1 ton of smoke per day. No smoke may be emitted without a permit. Suppose the government conducts the auction by starting at $1 and asking how many permits each firm wants to buy at that price. If the total is more than four, it then raises the price by $1 and asks again, and so on, until the total quantity of demanded permits falls to four. How much will each permit sell for in this auction? How many permits will each firm buy? What will be the total cost to society of this reduction in pollution?

A:

If Sludge Oil does not have any permits it will have to pay $500. Sludge Oil is therefore willing to pay up to $300 for the first permit, which is the cost difference between process E and process D. Sludge will pay up to $80 for the second permit, and so on.

If Northwest Lumber does not have any permits it will have to pay $2,000. Northwest Lumber is therefore willing to pay up to $1,000 for the first permit, which is the cost difference between process E and process D. Northwest will pay up to $500 for the second permit, up to $320 for the third, and up to $80 for the fourth.

Therefore, the auction price will keep rising until it reaches $81, the lowest price for which the total demand is 4 permits. Sludge Oil will buy 1 permit and Northwest Lumber will buy 3 permits. The total cost of the pollution reduction is $230. Sludge Oil now pays $200 instead of $50, and Northwest Lumber pays $180 instead of $100 - A senator has argued that we should not spend hundreds of billions of dollars to reduce greenhouse gas emissions because we are not even sure that such emissions will lead to costly changes in the Earth's climate. Comment critically on this argument.

A:

Countries maintain armies at great expense even when they are not certain that those armies will ever be called into action. If the consequences of being invaded are sufficiently grave, it can be rational to maintain an expensive army even if an invasion would never have occurred. The same logic applies in the case of investments in reducing greenhouse gases. Inherent uncertainties in climate science mean that we cannot be sure what the payoff from those investments will be. But the fact that climate estimates are highly uncertain means that the worst consequences could be very grave indeed. To reduce the likelihood of such consequences, it can be rational to invest heavily in reducing greenhouse gases - Suppose employers and workers are risk-neutral, and Congress is about to enact the $12 per hour minimum wage. Congressional staff economists have urged legislators to consider adopting an earned-income tax credit instead. Suppose neither workers nor employers would support that proposal unless the expected value of each party’s economic surplus would be at least as great as under the minimum wage. Describe an earned-income tax credit (and a tax that would raise enough money to pay for it) that would receive unanimous support from both workers and employers.

A:

Without a minimum wage, employers and workers each receive an economic surplus of $50,000 per day. As shown in the diagram below, a minimum wage set at $12 per hour reduces employer surplus to the area of the cross-hatched triangle, $32,000 per day, and increases worker surplus to the area of the four-sided shaded figure, $64,000 per day. The minimum wage thus reduces employer surplus by $18,000 per day and increases worker surplus by $14,000 per day. Based on this information, employers would be willing to pay a tax up to $18,000 to enact the earned-income tax credit rather than the minimum wage. A tax of $16,000 levied on employers could therefore fund an earned-income tax credit of $1.60 per hour × 10,000 hours = $16,000, which is more than the $14,000 increase in worker surplus that the minimum wage would provide. Clearly, this arrangement would make both employers and workers better off than under the minimum wage

The earned income tax credit provides a federal tax credit to low-income workers. It works like a negative income tax, except that eligibility for the program is confined to those who work. As a result, it does not provide assistance to individuals who are unemployed. Unlike the minimum wage, the earned income tax credit has no direct effect on the wage firms pay workers, and so it does not provide employers with an incentive to lay off low-wage workers. Since the earned income tax credit provides workers with cash (in the form of a tax credit), it is thought of a cash transfer program rather than an in-kind transfer program.

沒有留言:

張貼留言